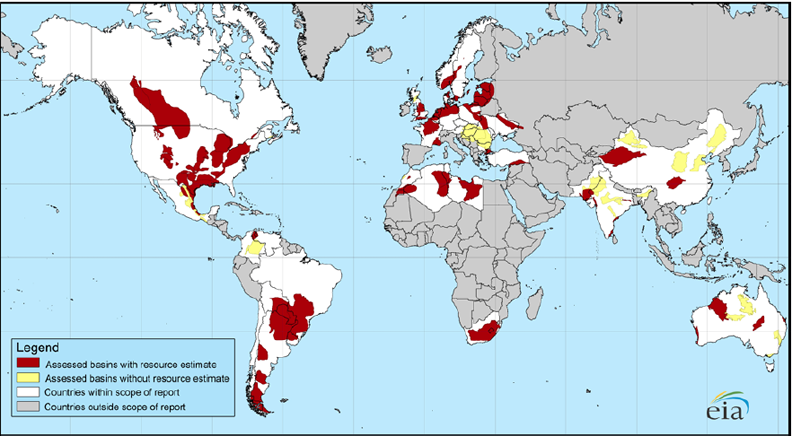

BigGav - The recent (optimistic) EIA report into global shale gas resources has local gas producers wondering if a repeat of the coal seam gas boom may be on the cards in Australia, particularly in South Australia and West Australia. The Australian reports on Santos’ interest in this other form of unconventional gas - Energy generators bet on shale gas future.

THE hype about shale gas increased yesterday ...which has turned US domestic energy markets on their heads.If the EIA is correct and approximately 385 tcf of gas can be extracted from shale in Australia, this would extend the lifespan of domestic gas production even under a scenario of greatly increased consumption to over a century (thus further undermining any arguments to restrict exports based on resource nationalism - though obviously environmental issues remain, particularly given the experience in the US with unconventional gas extraction).

The move comes on the back of a report by the US Energy Information Agency that said Australia was sitting on the world's fifth-biggest reserves of shale gas and was ready to become a major producer. A revolution in shale gas technology has turned the US from a net importer of gas to one with a surplus in just the past five years, capping gas prices and dashing a host of planned liquefied natural gas import terminals.

The EIA, which is the US Energy Department's respected statistics and analysis arm, completed a study of global shale gas prospects last month and found Australia was one of the most prospective countries for development. "With geologic and industry conditions resembling those of the US and Canada, the country is poised to commercialise its gas shale resources on a large scale," the EIA said.

Santos is planning to drill in the Cooper Basin, which straddles the South Australia/Queensland border. Beach Energy, which claims it has more prospective shale ground than Santos, has already drilled there and is planning to do a frac test -- where the shale is fractured to release gas -- this quarter.

Gas captured in shale does not flow as easily as conventional gas, which is released from the rocks it is found in by pressure alone. The recent technology breakthroughs of the last decade mean the shale can be fractured underground to release the gas relatively economically.